Prices indices, percentage changes, and weights for measure of consumer price inflation, UK.

Release date : 18 December 2024

Next release : 15 January 2025

Version : Latest

View previous releases

Contact : cpi@ons.gov.uk

Prices indices, percentage changes, and weights for measure of consumer price inflation, UK.

Release date : 18 December 2024

Next release : 15 January 2025

Version : Latest

View previous releases

Contact : cpi@ons.gov.uk

in 12 months to November 2024

in 12 months to November 2024

in 12 months to November 2024

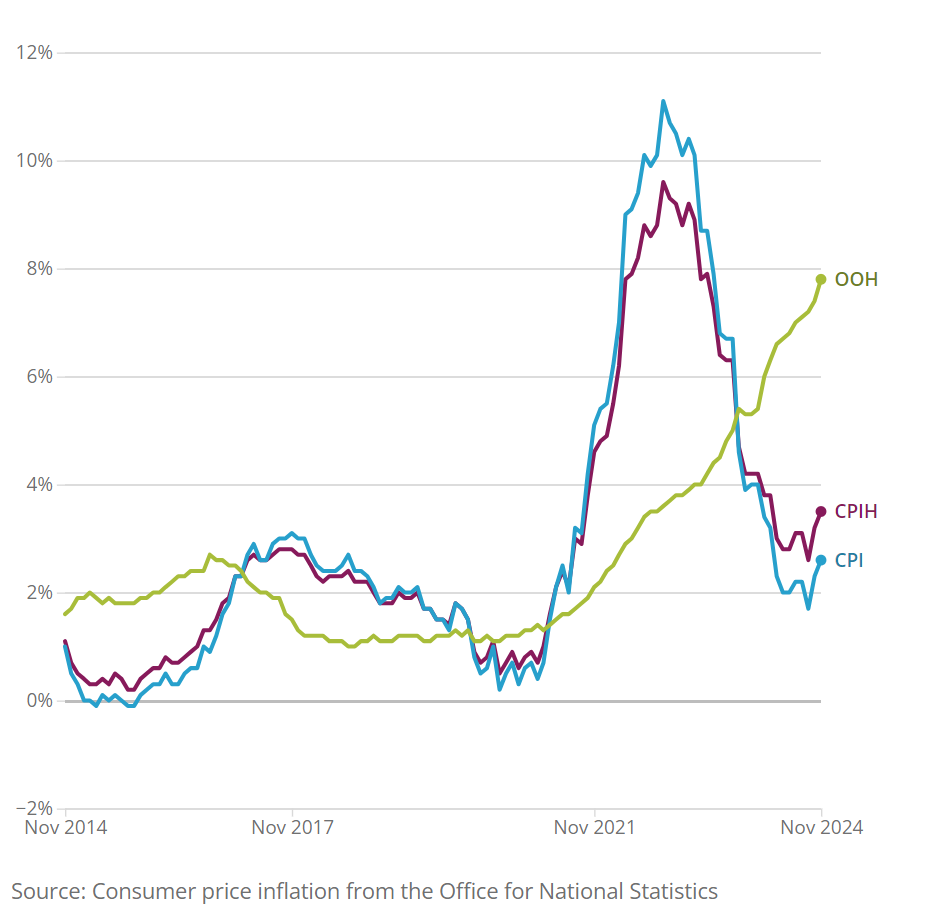

Annual consumer price inflation rates rose for the second month in a row in the 12 months to November 2024.

Both measures remain below their peak in October 2022 of 9.6% for CPIH and 11.1% for CPI.

Some of the main price changes behind the November 2024 rise (for CPIH) were:

“Inflation rose again this month as prices of motor fuel and clothing increased this year but fell a year ago.

“This was partially offset by air fares, which traditionally dip at this time of year, but saw their largest drop in November since records began at the start of the century.”

Grant Fitzner, Chief economist, Office for National Statistics

Excel spreadsheet (XLSX format, 26KB)

To understand the difference between our measures of consumer price inflation see the Definitions section.

Consumer spending is grouped into twelve categories, or “divisions” using the Classification of Individual Consumption According to Purpose (COICOP).

We use our most comprehensive measure of inflation – the Consumer Prices Index including owner-occupier housing costs (CPIH) - to set out which divisions have made the largest contribution to the change in annual inflation.

Overall prices in the transport division fell by 1.1% in the year to November 2024 (compared with a fall of 2.0% in the year to October).

This was mainly the result of upward effects from motor fuels and second-hand cars, partially offset by a downward effect from air fares.

Motor fuel

The average price of petrol rose by 0.8 pence per litre between October and November 2024 to 134.8 pence per litre (down from 151.0 pence per litre in November 2023). Diesel prices rose by 1.4 pence per litre in November 2024 to 140.5 pence per litre (down from 159.0 pence per litre in November 2023). These resulted in overall motor fuel prices falling 10.9% in the year to November 2024 (compared with a fall of 13.7% in the year to October).

Second-hand cars

Prices of second-hand cars fell by 0.2% between October and November 2024 (compared with a fall of 2.1% a year ago). On an annual basis, prices fell by 1.3% in the year to November 2024, compared with a fall of 3.2% in the year to October. The annual rate has been negative for 16 consecutive months, though it has grown less negative since May this year.

Air fares

Air fares fell by 19.3% on the month in November 2024 (compared with a fall of 13.9% a year ago). This was the largest November fall since monthly price collection began in 2001 and follows a relatively high figure for October. The movement was largely driven by falls in fares on European routes.

The inflation rate for housing and household services was 5.8% in November 2024 (up from 5.5% in October). On a monthly basis, prices rose by 0.6% in November 2024 (compared with a rise of 0.3% a year ago).

Housing and household services

The inflation rate for housing and household services was 5.8% in November 2024 (up from 5.5% in October). On a monthly basis, prices rose by 0.6% in November 2024 (compared with a rise of 0.3% a year ago).

Owner occupier's housing costs

The inflation rate for housing and household services was 5.8% in November 2024 (up from 5.5% in October). On a monthly basis, prices rose by 0.6% in November 2024 (compared with a rise of 0.3% a year ago).

Actual rentals

The annual rate for actual rentals for housing was 7.6% in November 2024 (up from 7.4% in October).

To see how changes to inflation affect your household budget you can use our personal inflation calculator.

Our shopping prices comparisontool shows how the average prices of items have changed over time.

More detail on contributions to the different measures of inflation are available in Changes in CPIH inflation and Changes in CPI inflation.

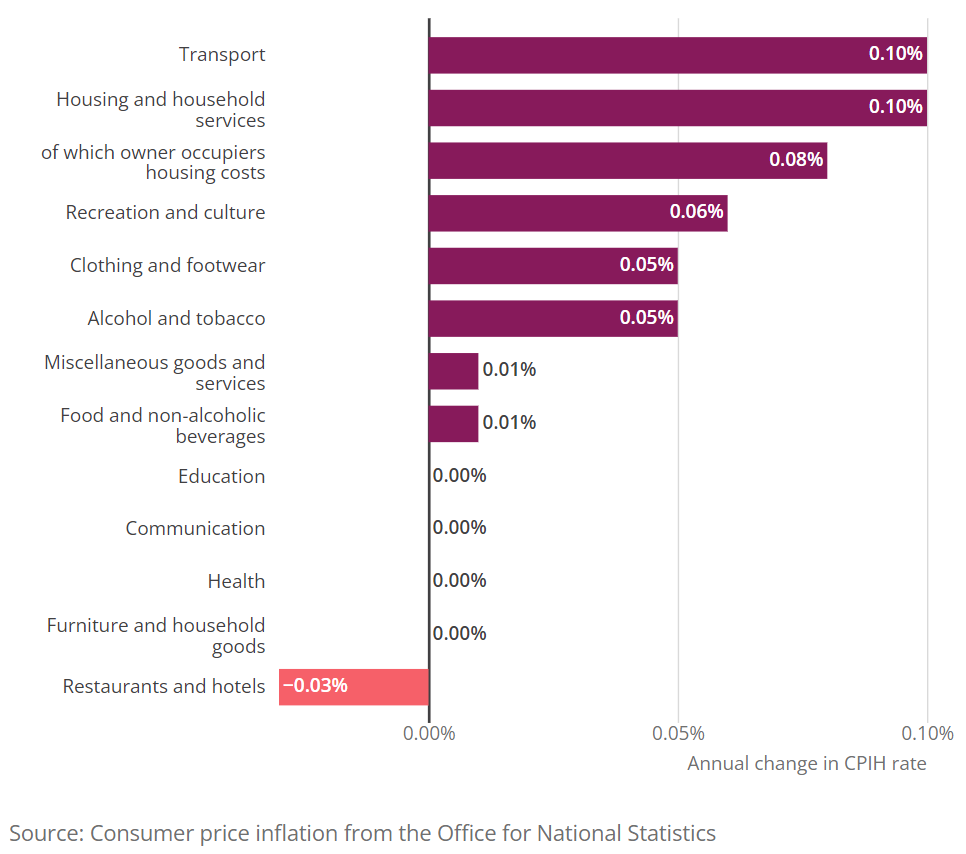

The annual CPIH inflation rate rose by 3.5% in the year to November 2024 (up from 3.2% in October).

On a monthly basis, CPIH rose by 0.2% in November 2024, compared with a fall of 0.1% a year earlier.

The increase in the annual CPIH inflation rate into November 2024 came from upward contributions from seven divisions, including transport, and housing and household services.

It was partially offset by a small downward contribution from restaurants and hotels.

Excel spreadsheet (XLSX format, 26KB)

The change in individual divisions sum to the change in the annual inflation rate between the latest two months (the rise from 3.2% to 3.5%).

Although the sizes of the contributions differ from CPI, the main drivers to the change are the same where they are common to both measures.

The largest upward contribution to the change in the annual rate came from housing services, principally from owner occupiers' housing costs (OOH).

Excel spreadsheet (XLSX format, 26KB)

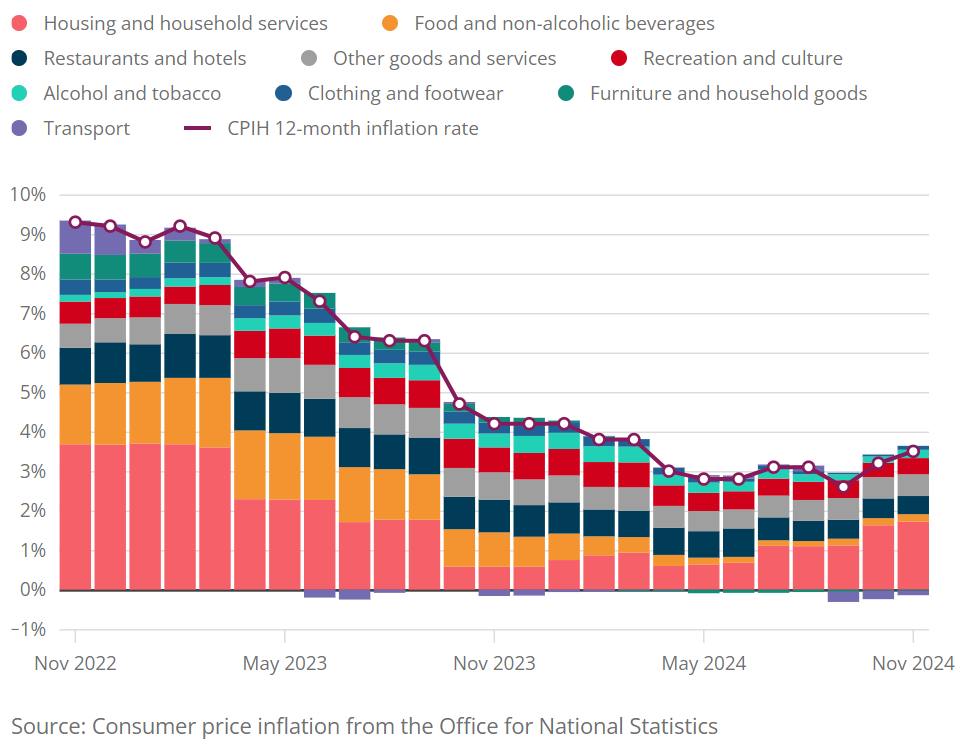

The largest upward contributions to the annual CPIH inflation rate in November 2024 came from

There were partially offsetting downward contributions from

The contribution from the housing and household services division was the largest since September 2023.

Excel spreadsheet (XLSX format, 26KB)

Owner occupiers' housing costs (OOH) contribution rose from 1.19 to 1.27 percentage points between October and November 2024.

This was the main influence behind the increased contribution from housing and household services to the annual CPIH inflation rate in November 2024

Excel spreadsheet (XLSX format, 26KB)

The core CPIH annual inflation rate (excluding energy, food, alcohol and tobacco which can be more volatile) was 4.4% in November 2024 (up from 4.1% in October and from a recent low of 4.0% in September).

The CPIH all goods index rose by 0.4% in the 12 months to November 2024 (compared with a fall of 0.3% in the 12 months to October).

There were upward contributions to the change in the annual rate from

The CPIH all services index rose by 5.7% in the 12 months to November 2024, slightly up from 5.6% in October.

The annual CPI inflation rate rose by 2.6% in the year to November 2024 (up from 2.3% in October).

On a monthly basis, CPI rose by 0.1% in November 2024, compared with a fall of 0.2% a year earlier.

The increase in the annual CPI inflation rate in November 2024 came from upward contributions from eight divisions, including transport, and recreation and culture. It was partially offset by a downward contribution from restaurants and hotels.

Excel spreadsheet (XLSX format, 26KB)

The change in individual divisions sum to the change in the annual inflation rate between the latest two months (the rise from 2.3% to 2.6%).

Although the sizes of the contributions differ from CPIH, the main drivers to the change are the same where they are common to both measures.

The CPIH includes extra housing components not included in the CPI. This can result in the largest contributions to the annual CPI and CPIH inflation rates coming from different divisions.

In November 2024, the largest-contributing division to CPI from the distinct categories of goods and services was restaurants and hotels (0.58 percentage point contribution to the CPI rate) while the largest-contributing division to CPIH was housing and household services.

OOH had a large upward contribution to housing and household services in CPIH but is excluded from CPI.

Excel spreadsheet (XLSX format, 26KB)

OOH had a large upward contribution to housing and household services in CPIH but is excluded from CPI.

Excel spreadsheet (XLSX format, 26KB)

Core CPI (excluding energy, food, alcohol and tobacco which can be more volatile) rose by 3.5% in the year to November 2024. This was up from 3.3% in October 2024 and from a recent low of 3.2% in September.

On a monthly basis, CPI rose by 0.1% in November 2024, compared with a fall of 0.2% a year earlier.

The CPI all goods index rose by 0.4% in the year to November 2024, compared with a fall of 0.3% in the year to October. The CPI all services index rose by 5.0% in the year to November 2024, unchanged from October.

As with the all-items annual inflation rates, the drivers of CPIH and CPI goods and services inflation are the same (except for owner occupiers' housing costs (OOH) and Council Tax, which are excluded from CPI).

While the Consumer Prices Index including owner occupiers' housing costs (CPIH) is our lead and most comprehensive measure of consumer price inflation, the Consumer Prices Index (CPI) is based on a harmonised methodology developed by Eurostat and allows for international comparisons.

The UK's CPI inflation rate of 2.6% was above the first (or "flash") estimates of inflation for France (1.7%) and Germany (2.4%) in the 12 months to November 2024. It was also above the United States figure of 2.3%.

While the UK CPI is produced on a comparable basis with EU countries, the United States Harmonised Index of Consumer Prices (HICP) measure differs in some respects (see Footnote of Figure 8).

Excel spreadsheet (XLSX format, 19KB)

Consumer price inflation is the rate at which the prices of goods and services bought by households rise or fall, estimated using price indices.

ONS produces several measures of consumer price inflation, including the following:

The most comprehensive measure of inflation. It includes owner occupier housing costs (OOH) which are not included in CPI.

Based on European regulations and produced to international standards, it is used in comparisons with other countries for the Harmonised Index of Consumer Prices. The government uses this measure in its inflation target.

Official statistics in development that provide more detailed insight on the impact of inflationary changes for different household sub-groups. See our Household Cost Indices for UK Household Groups article for more information.

An older measure of inflation which does not meet the standard of an accredited official statistic. We still publish RPI as it is widely used in contracts but do not encourage its use.

Measures of monthly UK inflation data including the Consumer Prices Index including owner occupiers' housing costs (CPIH), Consumer Prices Index (CPI) and Retail Prices Index (RPI). These tables complement the consumer price inflation time series dataset.

Comprehensive database of time series covering measures of inflation data for the UK including the CPIH, CPI and RPI.

The consumer price inflation detailed briefing note has details of the items contributing to the changes in the CPIH, details of any notable movements, a summary of the reconciliation of CPIH and RPI, and the outlook, which looks ahead to next month's release.

More quality and methodology information, including how the output is created and validated, is available in our Consumer Price Inflation QMI.

These accredited official statistics were independently reviewed by the Office for Statistics Regulation in February 2017. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled "accredited official statistics".

Office for National Statistics (ONS), released 18 December 2024, ONS website, statistical article, Inflation rises for second consecutive month in November 2024

Consumer Price Inflation team

cpi@ons.gov.uk

Telephone: +44 1633 456 900

Monday to Friday, 9am to 4pm